Andrii Yalanskyi/iStock via Getty Images

Both the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) and the Global X NASDAQ 100 Covered Call ETF (QYLD) offer compelling investment propositions to income-focused investors: They provide high-income yields from portfolios heavily focused on mega-cap technology stocks, which typically do not offer significant income when held directly. As a result, by investing in JEPQ or QYLD, income investors can achieve important diversification without sacrificing income. In this article, we will compare these funds side by side and offer our take on which is worth buying.

Covered Call Strategies

Both ETFs employ covered call strategies to generate income. JEPQ uses an active management approach, writing out-of-the-money NASDAQ 100 index call options to generate monthly distributable income for shareholders. Similarly, QYLD writes call options on the NASDAQ 100-Index (NDX), but the exact details of the options are driven by the individual portfolio managers, resulting in different yields and total returns for the two ETFs.

Portfolio Comparison

As of June 20th, both ETFs had similar portfolio compositions:

- JEPQ had 52.5% exposure to the technology sector, while QYLD had 52.6%.

- Both had identical exposure to the communications sector and very similar exposure to consumer cyclical, healthcare, consumer defensive, industrials, basic materials, utilities, energy, financials, and real estate sectors.

- Meanwhile, JEPQ's portfolio is slightly better diversified as its top ten holdings comprised 43.74% of its portfolio, whereas QYLD's top ten holdings made up 50%. That said, their top holdings were quite similar, with their top three holdings each being AI tech giants Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL). This makes both funds great ways to gain exposure to AI while also generating a very attractive monthly yield.

Yield and Expense Ratios

The trailing 12-month yield for JEPQ was 8.83%, compared to QYLD’s 11.73%. However, JEPQ has a lower expense ratio at 0.35%, significantly lower than QYLD’s 0.61%.

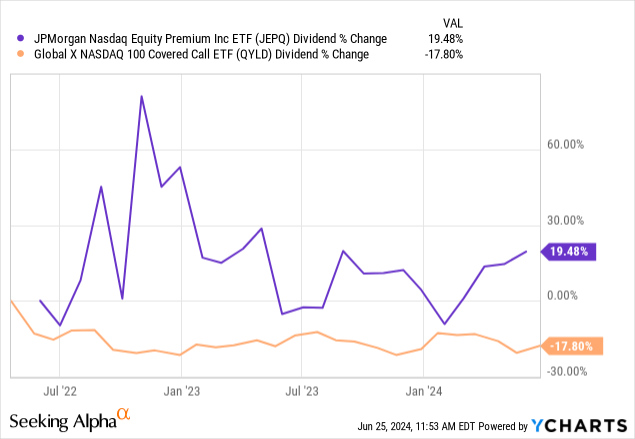

One advantage for QYLD is that its dividends have been meaningfully more stable than JEPQ's have been. This reflects a more disciplined approach by QYLD to deliver consistent income to shareholders, whereas JEPQ's management team has tended to take a more active approach in an attempt to maximize total returns for the fund at the expense of greater volatility in the dividends that it pays out:

Performance

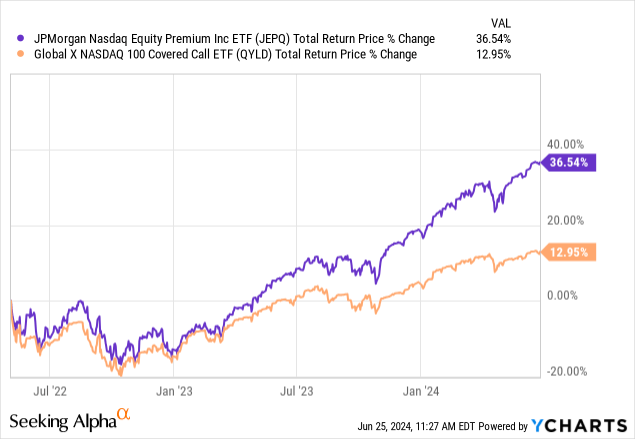

JEPQ's more flexible call writing strategy has paid off as it has massively outperformed QYLD since its inception, with a total return of 36.54% compared to QYLD’s 12.95%:

This outperformance is attributed to JEPQ's active management team’s superior handling of the call options strategy by balancing upside potential during bull markets with generating income during weaker markets. It is also noteworthy that JEPQ outperformed QYLD during both the tech downturn in 2022 and in the tech bull market that began in early 2023, further demonstrating its management team's adeptness at navigating changing market conditions.

Investor Takeaway

Given JEPQ's similar portfolio composition and strategy as QYLD (writing call options on the Nasdaq 100 index), significantly lower expense ratio, and vastly superior track record, it stands head and shoulders above QYLD. QYLD does have a few advantages, such as a longer track record, a higher trailing 12-month dividend yield, and a more consistent monthly dividend. However, JEPQ's nearly 9% yield is still substantial, making it a compelling choice for income investors. Additionally, JEPQ's larger assets under management improve its liquidity, though this is a minor issue.

Overall, JPMorgan Nasdaq Equity Premium Income ETF offers significant value for investors looking to diversify their income-focused portfolios with mega-cap technology exposure while maintaining or enhancing their overall portfolio yield. JEPQ's management success in navigating recent market swings in the tech sector provides confidence that it is a prudent way to gain exposure to the tech sector while generating attractive income. While we are not necessarily bullish on the mega-cap tech sector due to its high valuations, JEPQ could be a worthwhile hold for diversification and income for investors who focus on income investments. Moreover, we could potentially upgrade it to a Buy in the event of a meaningful correction in the mega-cap tech space.

source:seekingalpha